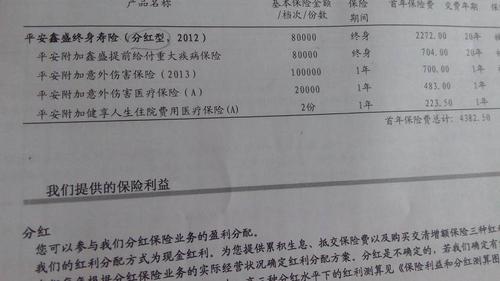

平安鑫盛终身寿险分红型2017条款

Title: Understanding Ping An Xinsheng Whole Life Insurance

Introduction

Ping An Xinsheng Whole Life Insurance is a comprehensive insurance product offered by Ping An Insurance, one of China's leading insurance companies. This insurance policy provides coverage for the insured's entire life, offering financial protection and various benefits to the policyholder and their beneficiaries. Let's delve deeper into the features, benefits, and considerations associated with Ping An Xinsheng Whole Life Insurance.

Key Features

1.

Lifetime Coverage

: Unlike term life insurance, which provides coverage for a specific term, Xinsheng Whole Life Insurance offers protection for the entire life of the insured, as long as premiums are paid.2.

Death Benefit

: In the event of the insured's death, the policy pays out a death benefit to the designated beneficiaries. This benefit can help replace lost income, cover funeral expenses, and provide financial support to loved ones.3.

Cash Value Accumulation

: A portion of the premiums paid accumulates as cash value over time. This cash value grows on a taxdeferred basis and can be accessed by the policyholder through policy loans or withdrawals, providing a source of liquidity.

4.

Dividend Payments

: Policyholders may receive dividends from the insurance company, depending on the company's financial performance and the specific terms of the policy. These dividends can be used to enhance the policy's value by purchasing additional coverage, reducing premiums, or accumulating cash value.5.

Flexible Premiums

: Xinsheng Whole Life Insurance offers flexibility in premium payments, allowing policyholders to choose from various payment options, including single premium, limited premium, or regular premium payments, based on their financial circumstances and preferences.Benefits

1.

Financial Security

: The primary benefit of Ping An Xinsheng Whole Life Insurance is the financial security it provides to the insured's beneficiaries in the event of their death. This can help ensure that loved ones are taken care of financially, including covering living expenses, education costs, and mortgage payments.2.

Wealth Accumulation

: The cash value component of the policy serves as a longterm savings vehicle, allowing policyholders to accumulate wealth over time. This can be particularly beneficial for retirement planning or other financial goals.3.

Tax Advantages

: The cash value growth within the policy is taxdeferred, meaning that policyholders do not pay taxes on the accumulated earnings until they are withdrawn. Additionally, death benefits are generally received taxfree by the beneficiaries, providing valuable tax advantages.4.

Peace of Mind

: Knowing that one has comprehensive life insurance coverage in place can provide peace of mind, allowing individuals to focus on other aspects of their lives without worrying about the financial wellbeing of their loved ones.Considerations

1.

Cost

: While whole life insurance offers lifelong coverage and cash value accumulation, it tends to have higher premiums compared to term life insurance. It's essential to consider whether the benefits outweigh the costs and fit within your budget.2.

LongTerm Commitment

: Purchasing a whole life insurance policy is a longterm commitment that requires regular premium payments over many years. Be sure to assess your financial situation and ensure that you can afford the premiums for the duration of the policy.3.

Policy Illustrations

: When considering Xinsheng Whole Life Insurance or any insurance product, it's crucial to review policy illustrations provided by the insurer. These illustrations project the policy's performance based on various assumptions and can help you understand how the policy may grow over time.4.

Policy Flexibility

: While whole life insurance policies offer some flexibility, such as the ability to access cash value or adjust premium payments, there may be limitations and restrictions outlined in the policy contract. Familiarize yourself with these terms to avoid any surprises in the future.Conclusion

Ping An Xinsheng Whole Life Insurance offers lifelong coverage, cash value accumulation, and various benefits to policyholders and their beneficiaries. By understanding its features, benefits, and considerations, individuals can make informed decisions about whether this insurance product aligns with their financial goals and provides the necessary protection for themselves and their loved ones. Always consult with a qualified insurance advisor to explore options and tailor a policy to your specific needs and circumstances.