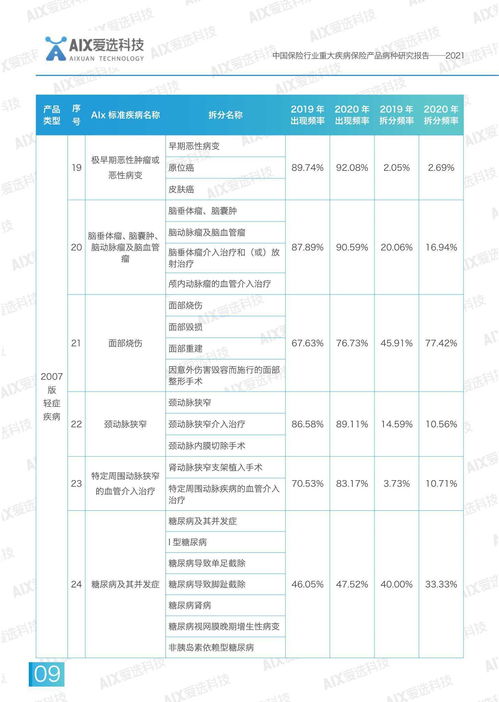

大病报销单怎么看

Understanding Critical Illness Insurance: A Comprehensive Guide

Critical illness insurance, also known as major medical insurance or catastrophic health insurance, is a type of insurance coverage that provides financial protection in the event of a serious illness or medical condition. This insurance typically pays out a lump sum benefit upon diagnosis of a covered illness, which can help policyholders cover medical expenses, loss of income, and other related costs.

What Does Critical Illness Insurance Cover?

Critical illness insurance policies vary in terms of the illnesses and conditions they cover, but most plans typically include coverage for the following:

1.

Cancer

: This is one of the most common conditions covered by critical illness insurance. Policies usually cover various types and stages of cancer, including but not limited to breast cancer, lung cancer, prostate cancer, and leukemia.2.

Heart Attack

: Critical illness insurance often provides coverage for heart attacks, which occur when the blood flow to the heart is blocked, leading to damage or death of heart muscle tissue.3.

Stroke

: A stroke happens when blood flow to part of the brain is interrupted, leading to brain cell damage or death. Critical illness insurance typically covers strokes and their related complications.4.

Organ Failure

: Critical illness policies may cover organ failures such as kidney failure, liver failure, or lung failure, which require significant medical intervention such as organ transplantation.5.

Major Organ Transplant

: Coverage may extend to the costs associated with receiving a major organ transplant, including the surgery itself, postoperative care, and immunosuppressive medications.6.

Paralysis

: Some policies provide coverage for paralysis resulting from a spinal cord injury or other medical conditions, which can help cover the costs of medical care and ongoing rehabilitation.7.

Severe Burns

: Critical illness insurance may also cover severe burns requiring extensive medical treatment, including skin grafts and rehabilitation therapy.

How Does Critical Illness Insurance Work?

When you purchase a critical illness insurance policy, you pay regular premiums to the insurance company. In return, the insurance company agrees to pay out a lump sum benefit if you are diagnosed with a covered illness or condition during the policy term.

Here's how the process typically works:

1.

Diagnosis

: If you are diagnosed with a covered critical illness, you must submit a claim to your insurance provider along with any required medical documentation, such as diagnostic test results and physician reports.2.

Review and Approval

: The insurance company will review your claim to ensure that it meets the policy's criteria for coverage. This may involve verifying your medical diagnosis and confirming that the illness is covered under your policy.3.

Benefit Payment

: If your claim is approved, the insurance company will pay out the agreedupon lump sum benefit directly to you or your designated beneficiary. You can use this money to cover medical expenses, replace lost income, or address any other financial needs that arise due to your illness.Key Considerations When Buying Critical Illness Insurance

Before purchasing a critical illness insurance policy, there are several important factors to consider:

1.

Coverage Options

: Review the list of covered illnesses and conditions to ensure that the policy provides the level of coverage you need. Consider factors such as your family medical history, lifestyle, and personal health risk factors when selecting coverage.2.

Policy Limits and Exclusions

: Pay attention to any limits on coverage, such as maximum benefit amounts or waiting periods before benefits are paid. Additionally, be aware of any exclusions or limitations that may apply to certain preexisting conditions or highrisk activities.3.

Premium Costs

: Compare premium costs from multiple insurance providers to find a policy that offers affordable coverage within your budget. Keep in mind that premiums may vary based on factors such as age, health status, and coverage amount.4.

Policy Features

: Evaluate additional features or riders that may be available with the policy, such as return of premium options, guaranteed insurability, or coverage for additional illnesses beyond the standard list.5.

Financial Stability of the Insurer

: Research the financial strength and reputation of the insurance company before purchasing a policy. Choose a reputable insurer with a track record of reliable claims processing and customer service.Conclusion

Critical illness insurance can provide valuable financial protection in the event of a serious illness or medical condition. By understanding how these policies work and carefully evaluating your coverage options, you can make informed decisions to protect yourself and your loved ones against the financial impact of major health crises. Be sure to consult with a licensed insurance agent or financial advisor to explore your options and find the right critical illness insurance policy for your needs.